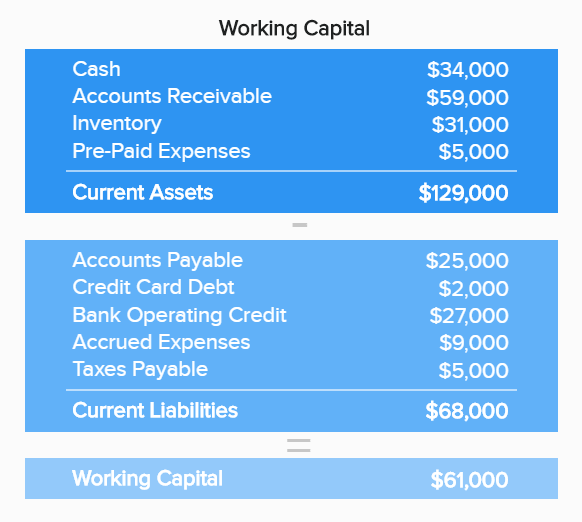

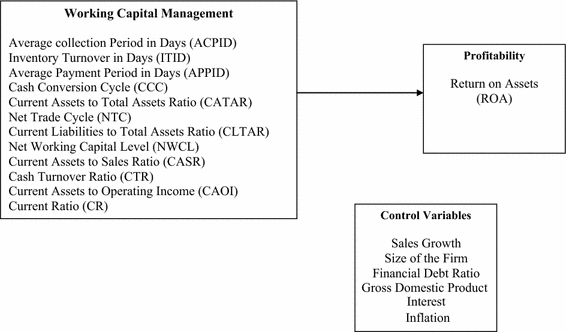

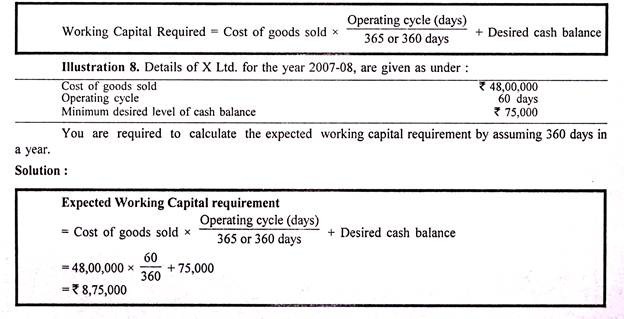

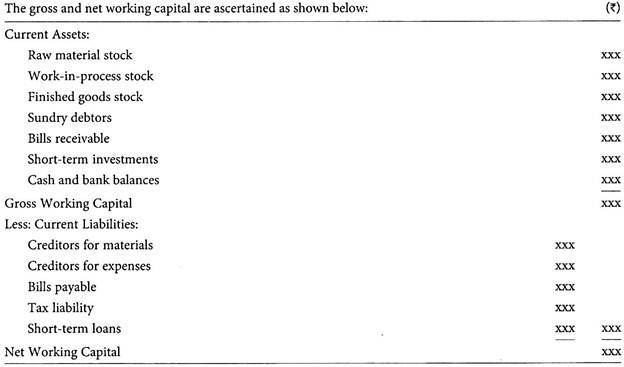

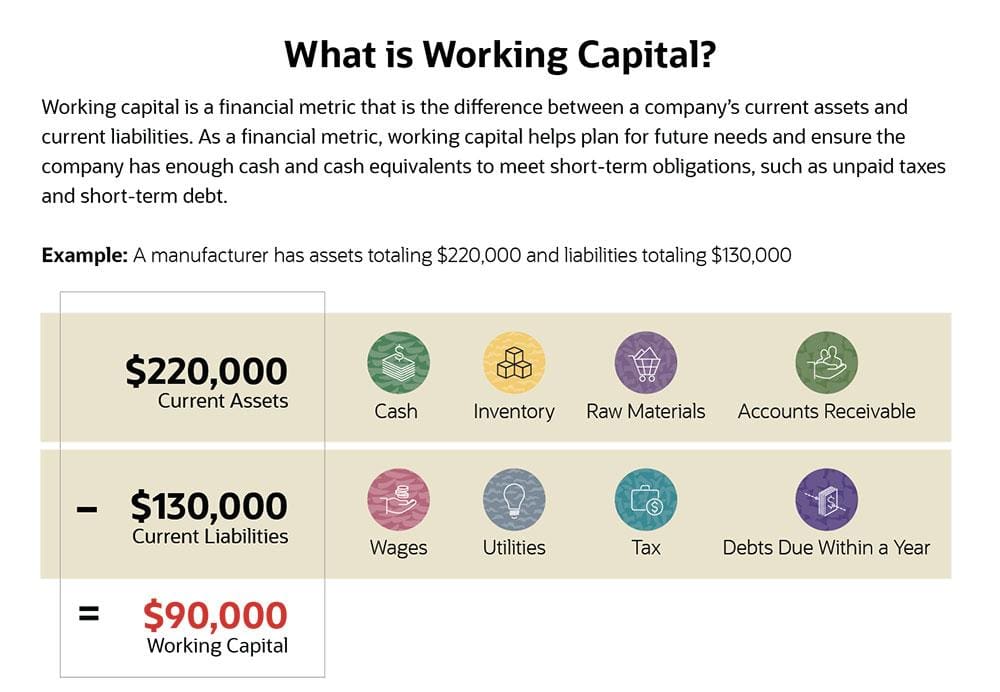

In general, working capital policies involve determining the sources of finance It also determines the allocation of these finances towards current assets and liabilities Broadly, three strategies can help optimise working capital financing for a business, namely, hedging, aggressive, and conservative, as per the risk levels involved 1 Now, lets us apply the formula to determine the working capital of Max Electronics Working Capital = Current Asset Current Liabilities 72,26,215 – = 35,25,869 The working capital of Max Electronics is 35,25,869 Types of working capital management ratiosNormal level of net working capital The normal level of working capital is an amount defined in the purchase agreement and referred to as a net working capital target, a net working capital peg or net working capital true up The required level of working capital is generally calculated as the average of the last twelve months (LTM) By taking twelve months any seasonality impact is

How To Calculate Working Capital With Calculator Wikihow

How to calculate for working capital

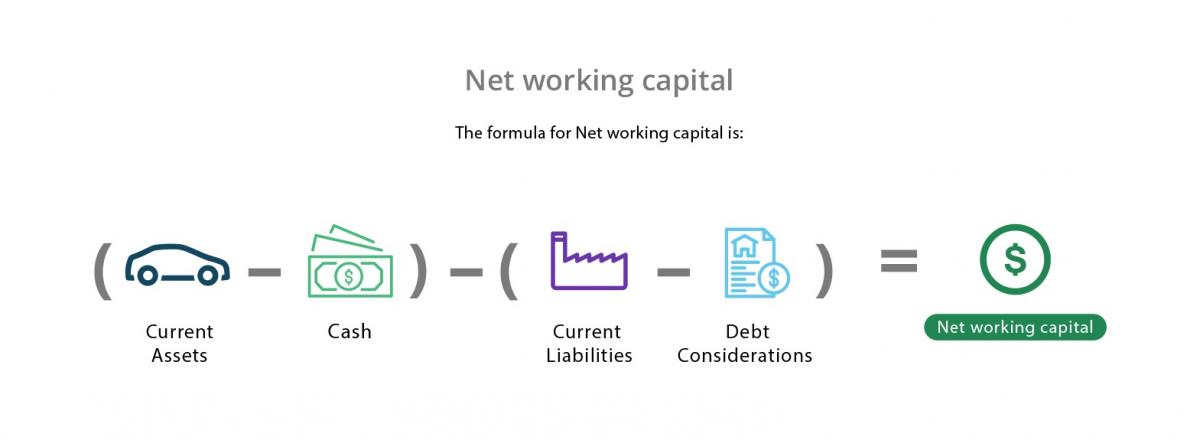

How to calculate for working capital-In this ratio working capital is defined as the level of investment in inventory and receivables less payables In exam questions you may have to assume that yearend working capital is representative of the average figure over the year The sales to working capital ratio indicates how efficiently working capital is being used to generate salesFor example, if current assets are $1M and current liabilities are $750k then net working capital is $250k and the working capital ratio is 133 In this case there is positive working capital If current liabilities are greater than current assets then the company is

Working Capital Management Businance

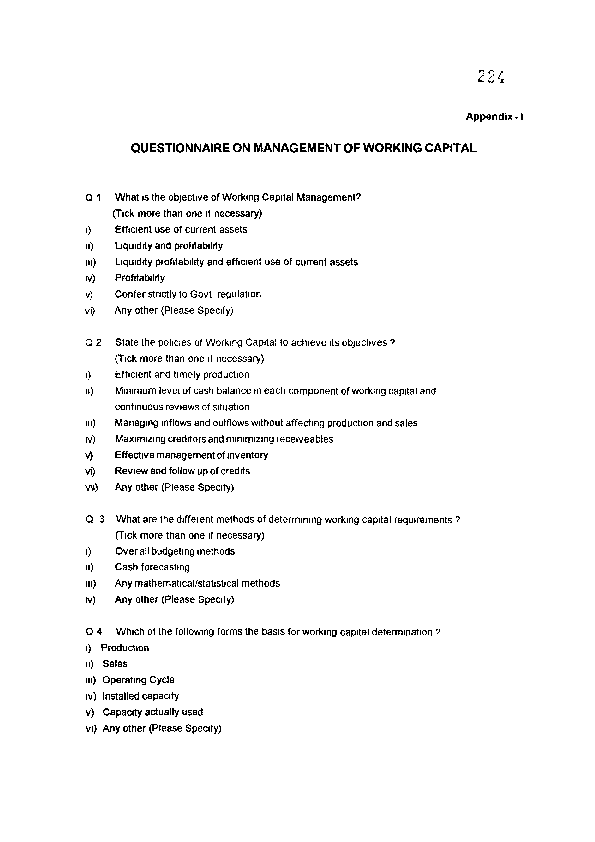

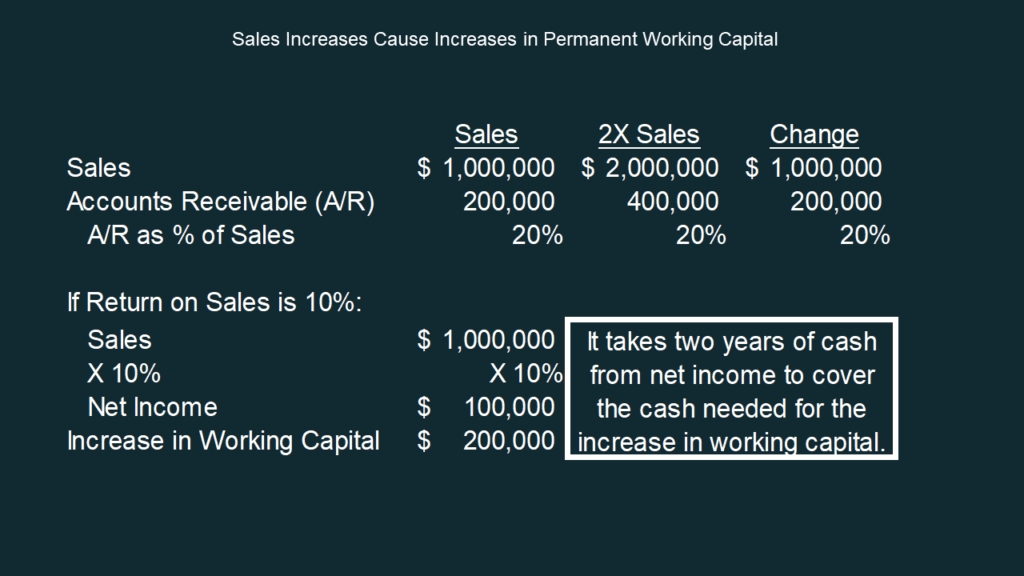

How is net working capital determined? There is no formula for calculating the exact permanent working capital It is an estimation based on the experience of the entrepreneur Statistical data on the balance of all current assets and liabilities can help in deciding that levelThe inventory to working capital formula is as follows Inventory Working Capital Ratio = Inventory / Working capital Inventory to Working Capital Calculation For example, a company has $10,000 in working capital and $8,000 in inventory Working capital = 8,000 / 10,000 = 08 This means that $08 of a company's fund is tied up in inventory

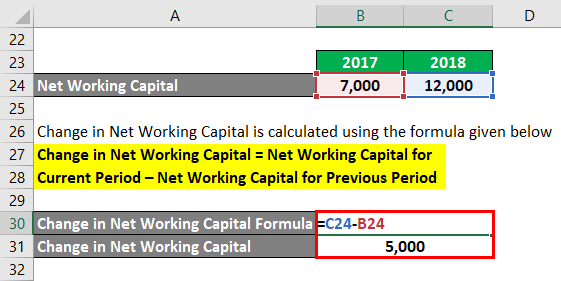

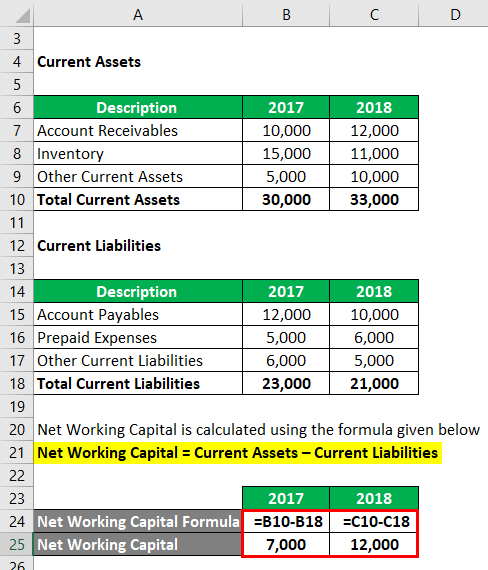

Calculate the change in net working capital by taking a difference of the calculated working capitals Examples of Change in Net Working Capital Formula (With Excel Template) Negotiating working capital is one of the most contentious issues in closing a deal That's because determining the amount of sufficient working capital needed to fund ongoing business is a complicated exercise Robert B Moore, Partner, McGladrey LLP, has expertly summarized the issues is his white paper, "Negotiating Working Capital Targets and Definitions"Sales to working capital ratio is a liquidity and activity ratio that shows the amount of sales revenue generated by investing one dollar of working capital Assets, also called working capital, represent items closely tied to sales, and each item will directly affect the results

Net working capital is an important component to any transaction Gaining a comprehensive understanding of net working capital provides buyers the level of cash required to operate the business post transaction close, thereby avoiding unanticipated additional cash infusionIf you have current assets of $1 million and current liabilities of $500,000, your working capital ratioPermanent / Fixed working capital – the level of working capital below which the business has never gone;

How To Calculate Working Capital Requirement Plan Projections

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital for Previous Period = Current Assets for Previous Period – Current Liabilities for the Previous Period; The formula is How to Interpret Working Capital Under the best circumstances, insufficient working capital levels can lead to financial pressures on a company, which will increase its borrowing and the number of late payments made to creditors and vendorsWorking Capital Ratios (liquidity) • The "liquidity position" of a business refers to its ability to pay its debts – ie does it have enough cash to pay the bills?

Changes In Working Capital Fcf And Owner Earnings

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

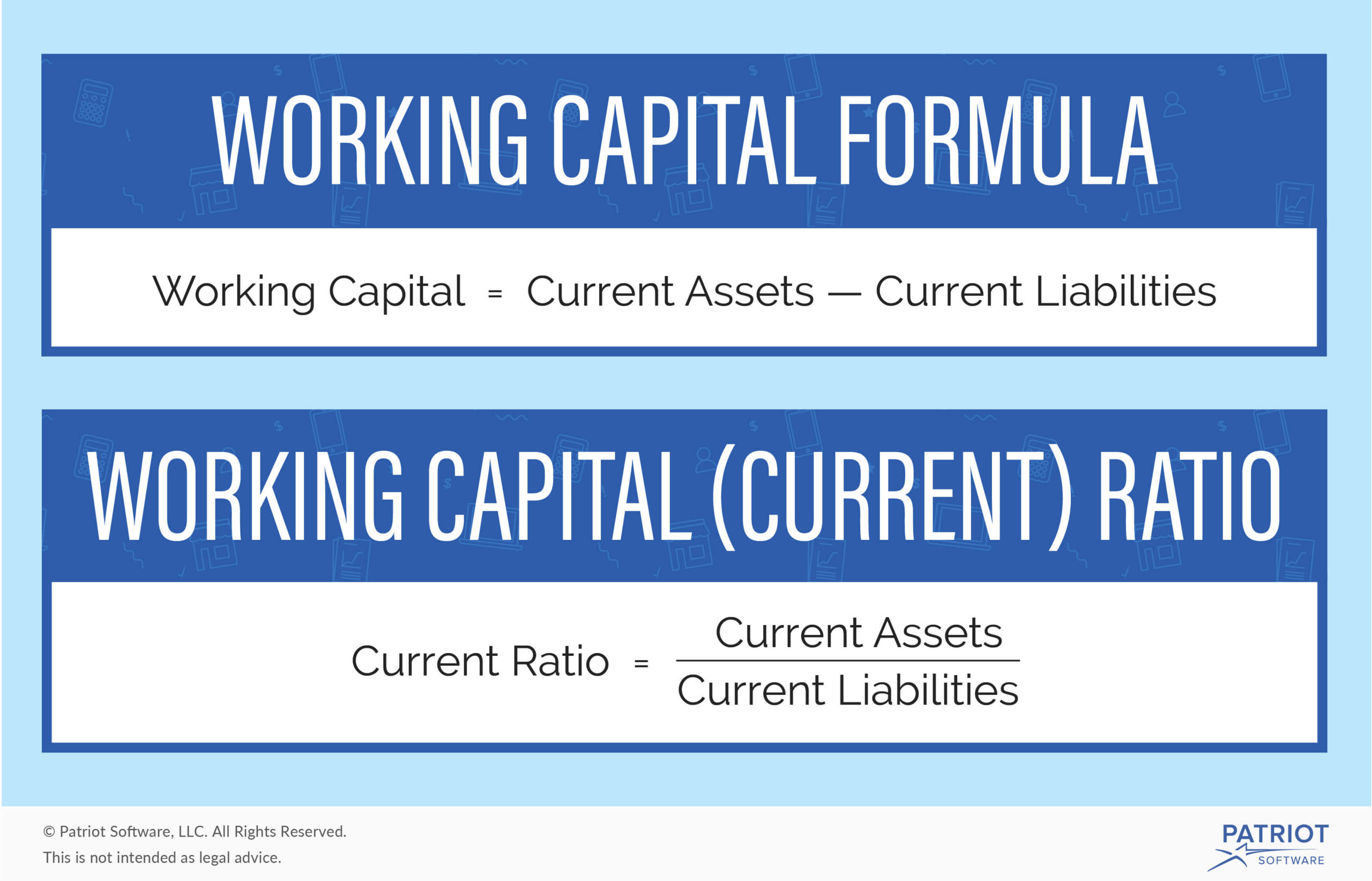

The key is thus to maintain an optimal level of working capital that balances the needed financial strength with satisfactory investment effectiveness To accomplish this goal, working capital is The Usefulness of Working Capital Many entrepreneurs believe that capital is one of the most useful figures that can be extracted from a balance sheet Understanding the meaning of working capital can help your company make important decisions such as How to adjust your level of capital use in response to changes in your business cycleThe working capital ratio is calculated simply by dividing total current assets by total current liabilities For that reason, it can also be called the current ratio It is a measure of liquidity, meaning the business's ability to meet its payment obligations as they fall due

Working Capital Example Formula Wall Street Prep

Management Financing Of Working Capital Ppt Download

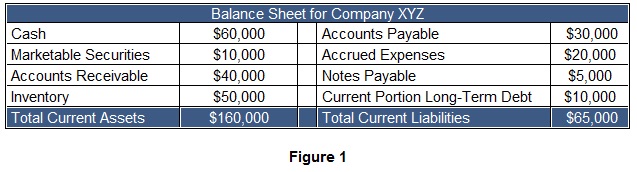

Cash Current assets divided by current liabilities is known as a working capital ratio To calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This indicates whether a company possesses enough shortterm assets to cover shortterm debtLong term sources of capital used to coverAS, A Level Board AQA, Edexcel, OCR, IB By adding together the totals for current assets and current liabilities in the balance sheet, a very important figure can be calculated – working capital Working capital = current assets less current liabilities

Chapter 2 Working Capital Sreyya Yilmaz Ra Working

What Is Net Working Capital How To Calculator Nwc Formula

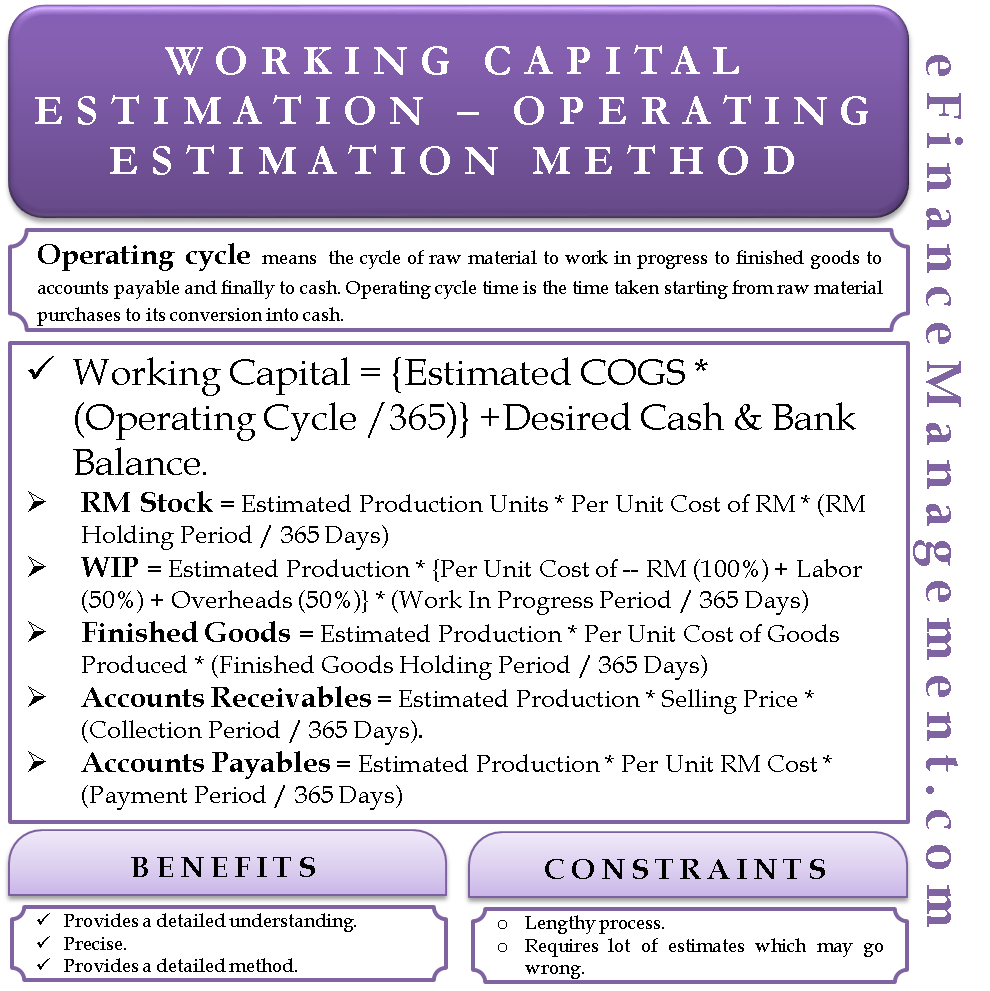

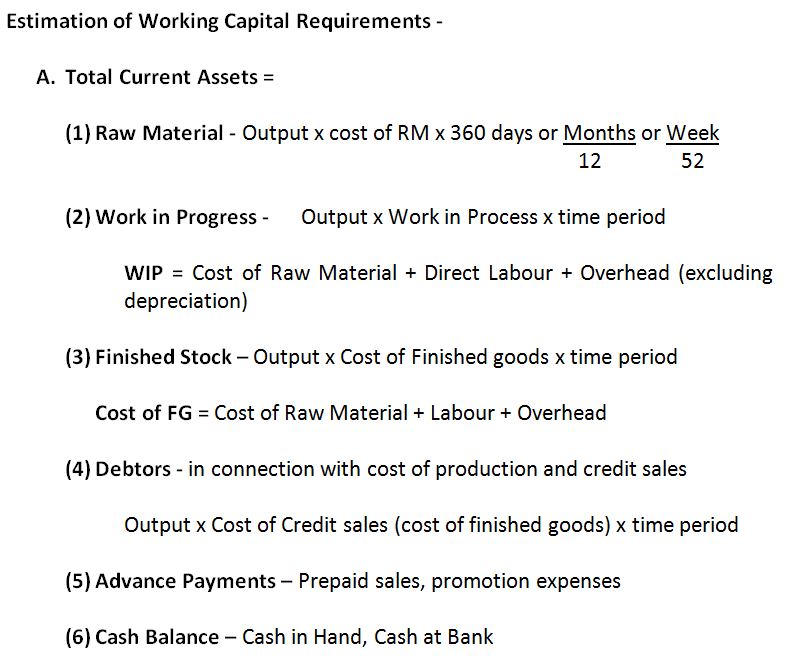

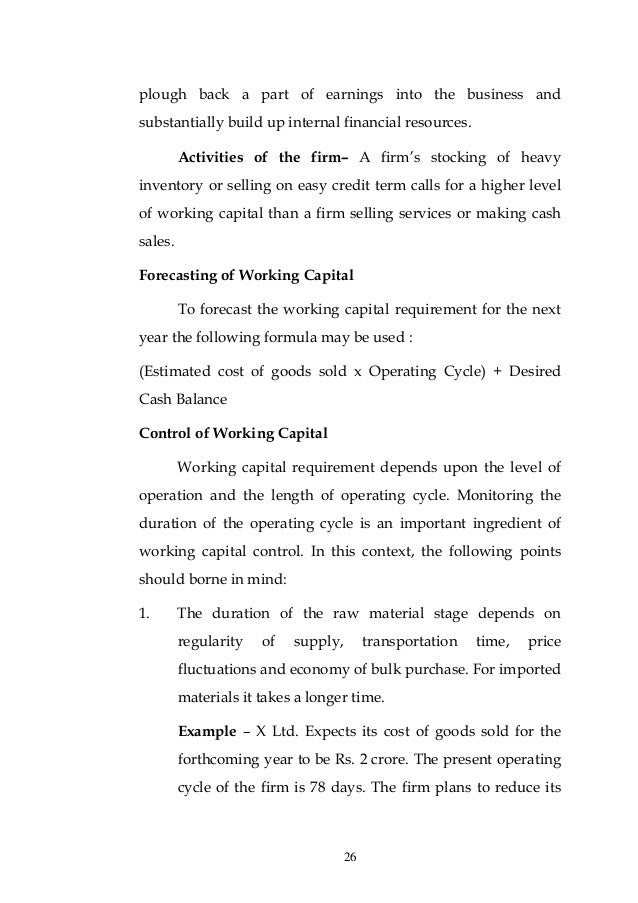

Net Working Capital Ratio Formula = Net Working Capital/Total Assets = (Current Assets – Current Liabilities)/Total Assets This ratio indicates the amount of funds invested in fixed assets An increasing ratio indicates that your business is reducing its investments in fixed assets And increasing investment in liquid assetsInventory to working capital is a liquidity ratio that measures the amount of working capital that is tied up in inventory The difference between total current assets and total current liabilities is known as working capital or net working capitalWorking capitalThe following points highlight the top three methods of working capital estimation The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 Operating Cycle Method 1 Percentage of Sales Method It is a traditional and simple method of determining the level of working capital and its components

Working Capital Formula Runningface

Cfa Level I Working Capital Management Part I Youtube

Postclosing or calculation disputes Such a formula would assign a certain percentage credit to the working capital depending on the aging schedule for the receivables For example, all receivables less than 30 days old would receive 90% credit in working capital, 3060 day receivables would be credited 75%, 6090 day• The balance sheet of a business provides a "snapshot" of the working capital position at a particular point in time You can use the following formula for calculating NWC ratio Net Working Capital Ratio = Current assets ÷ Current Liabilities Here's a couple examples A business has current assets totaling $150,000 and current liabilities totaling $100,000 That means their NWC ratio is

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Formula Calculations Examples And Tips India Dictionary

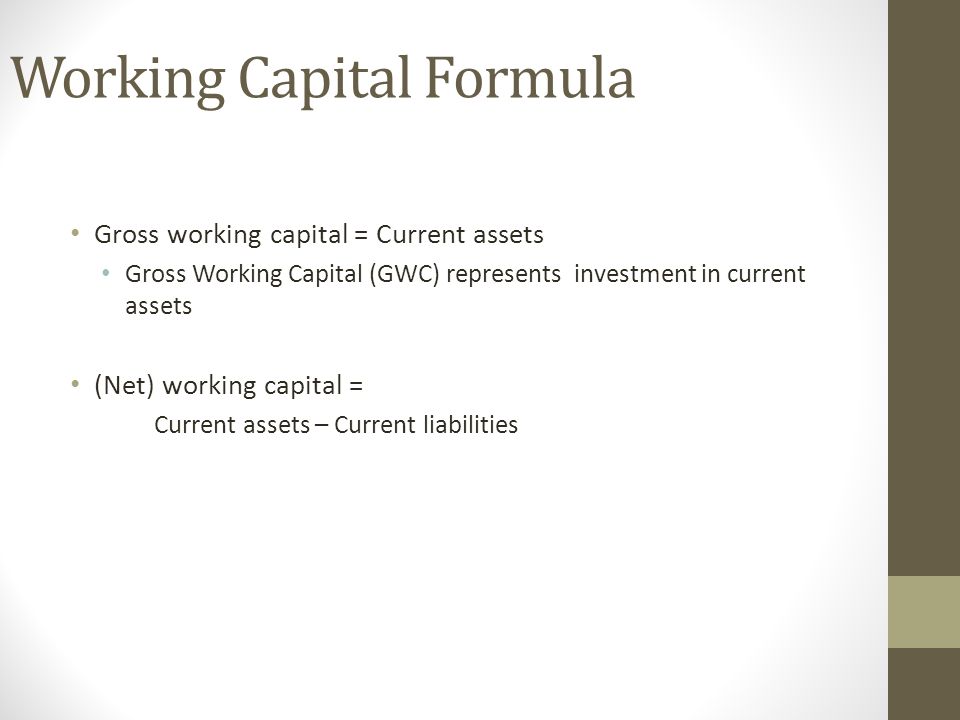

At a high level, the calculation of working capital is as follows Current assets Current liabilities = Working capital The working capital figure will likely change every day, as additional accounting transactions are recorded in the accounting systemA Brief Understanding of Working Capital As It Pertains to Your Business The Basic Formula It has been said that the lifeblood of any business is its net working capital (WC) The simplest explanation of this figure is the formula WC = Current assets – Current liabilitiesYou can get a sense of where you stand right now by determining your working capital ratio, a measurement of your company's shortterm financial health Working capital formula Current assets / Current liabilities = Working capital ratio;

Curve Estimation Regression Models Between The Level Of Working Capital Download Scientific Diagram

Change In Net Working Capital Formula Calculator Excel Template

Working capital is usually defined as net current assets (excluding cash) adjusted for any debtlike items such as unpaid corporation tax, loans and hire purchase liabilities There is no standard formula for how to calculate the NWC and every transaction is unique in this regard, but any calculation must have regard to both timing and content Working capital is a snapshot of a present situation, while cash flow measures the ability to generate cash over a specific period Most businesses with high cash flow will also have high working capital But there can be some divergence depending on things like investments, paying off old debt and paying dividends to shareholders The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales Working capital is current assets minus current liabilities A high turnover ratio indicates that management is being extremely efficient in using a firm's shortterm assets and liabilities to support sales

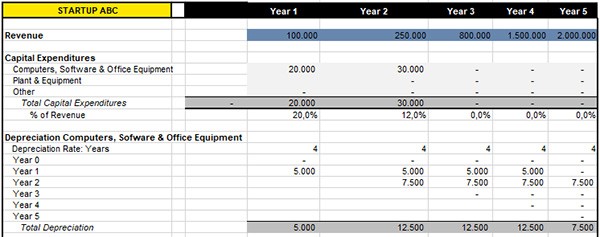

The Ultimate Guide To Financial Modeling For Startups Ey Netherlands

Working Capital And Liquidity Explanation Accountingcoach

For the experienced seller and their team, terms and conditions of the deal can be just as critical as the purchase price One of those key terms is called the working capital target In accounting terms, working capital is equal to current assets minus current liabilities Working capital is calculated by using the current ratio, which is current assets divided by current liabilities A ratio above 1 means current assetsThe following tables illustrate typical working capital trends seen in these categories Working capital amounts can be small at one company and quite significant at another Looking at working capital as part of the total deal or in relation to sales, can show that it varies in importance from company to company

Change In Working Capital Video Tutorial W Excel Download

Working Capital Formula Calculator Excel Template

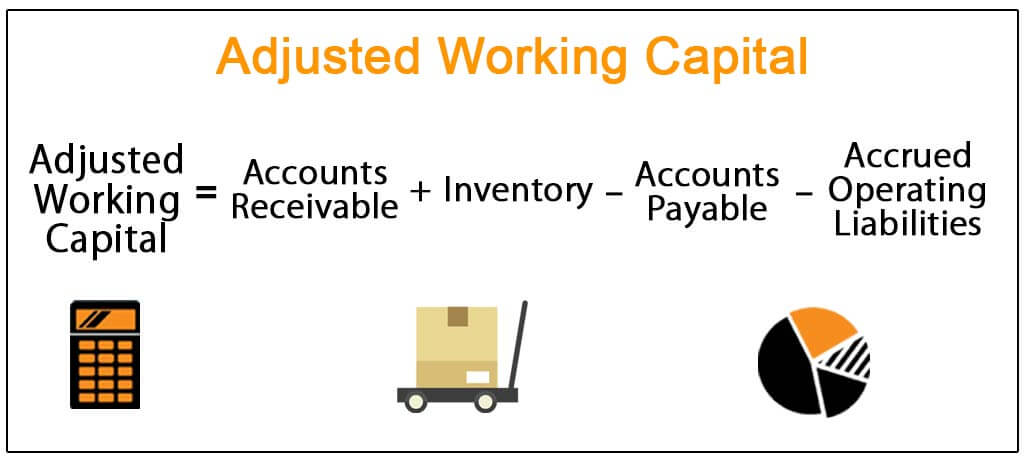

Operating working capital needs to be kept as low as possible, even down into negative values, in order to improve the cash position To control the stock level, the purchasing volume needs be fine tuned to the latest sales trend and forecast How to calculate working capital Working capital formula Formula Net Working Capital = Current Assets (less cash) – Current Liabilities (less debt) or, NWC = Accounts Receivable Inventory – Accounts Payable The first formula above is the broadest (as it includes all accounts), the second formula is more narrow, and the last formula is the most narrow (as it only includes three accounts)The working capital formula is Working Capital = Current Assets – Current Liabilities The working capital formula tells us the shortterm liquid assets available after

How To Calculate Working Capital The Working Capital Formula

Working Capital Formulas And Why You Should Know Them Fundbox

To determine what a "normal" level is for NWC, an average of the previous six to 12 months is often used, which may be referred to as the "target" or "peg" At closing, the actual NWC delivered is compared to an agreedupon target and a "trueup" then occurs The level of working capital affects the degree of risk and profitability both Hence the level of working capital should be so fixed that, on the one hand, its financial soundness is maintained and on the other hand, its profitability is optimized At this point it is necessary to be clear about the meaning of solvency or insolvency of the firmFormula The working capital ratio is calculated by dividing current assets by current liabilities Both of these current accounts are stated separately from their respective longterm accounts on the balance sheet This presentation gives investors and creditors more information to analyze about the company Current assets and liabilities are

Net Working Capital Formula What It Is How To Calculate It And Examples Planergy Software

Pdf Balance Sheet Ratios And Analysis For Cooperatives Abilash Sjr Academia Edu

Understanding Working Capital Targets in M&A Transactions We have found that net working capital ("NWC") targets are one of the most commonly misunderstood components of M&A deals While sometimes confusing, we believe sellers need to understand the logic behind NWC targets, as it can often become one of the more heavily negotiated items

Working Capital Definition Formula Examples With Calculations

Gross Working Capital And Net Working Capital

Working Capital Management Businance

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Working Capital Management Acca Global

Impact Of Working Capital Management Practices On Firm Value Pdf Free Download

Financial Kpis Metrics See The Best Finance Kpi Examples

Working Capital Net Current Assets Tutor2u

Working Capital Formula How To Calculate Working Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital What It Is And How To Calculate It Efficy

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Cycle

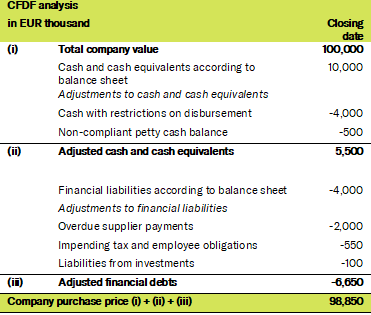

M A Vocabulary Explained By The Experts Cash Free Debt Free Rodl Partner

Working Capital What It Is And How To Calculate It Efficy

How To Calculate Working Capital With Calculator Wikihow

How To Calculate Working Capital With Calculator Wikihow

Positive Vs Negative Working Capital Gocardless

How To Calculate Working Capital With Calculator Wikihow

Working Capital Meaning Ratio Example Formula Cycle

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Formula How To Calculate Working Capital Requirement Bajaj Finserv

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

Chapter 7 Working Capital Management

Working Capital Formula How To Calculate Working Capital

Change In Net Working Capital Formula Calculator Excel Template

The Determinants Of Working Capital Management And Firms Performance Of Textile Sector In Pakistan Springerlink

Operating Working Capital Owc Financial Edge

Assessment And Computation Of Working Capital Requirement

Working Capital Example Meaning Investinganswers

How To Calculate Working Capital The Working Capital Formula

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

Net Working Capital Formulas Examples And How To Improve It

The Ins And Outs Of Business Working Capital Calculation Examples

Working Capital Requirement a Mantra

Working Capital Management Acca Global

1

Working Capital Financial Edge

Working Capital Estimation Operating Cycle Method

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital Formula Ratio How To Calculate Working Capital

1

1

What Is Working Capital Turnover Pdf Working Capital Revenue

Chapter 7 Working Capital Management

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

Working Capital Formula How To Calculate Working Capital

Working Capital Example Meaning Investinganswers

Working Capital In Valuation

Working Capital Know About Its Formula Definition And Calculation

Working Capital White Paper

Working Capital Requirement a Mantra

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital Example Formula Wall Street Prep

Working Capital Demystified Midaxo

Working Capital Demystified Midaxo

Days Working Capital Formula Calculate Example Investor S Analysis

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Management Module 1 Introduction Working Capital Or Short Term Finance Refers To Current Assets And Current Liabilities There Are Two Ppt Download

What Is Working Capital Here S Everything You Need To Know Freshbooks Blog

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Working Capital Requirement Wcr How To Assess It Euler Hermes

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Management Businance

Adjusted Working Capital Definition Formula Example

Working Capital Examples And Calculation Formula The Ratio Of Own Working Capital

M5 Partnerships Book Pages 251 276 Flip Pdf Download Fliphtml5

Formuleblad Financiering Bemfc Fi V1415 Windesheim Studeersnel

Working Capital Example Formula Wall Street Prep

What Is The Working Capital Cycle Touch Financial

Net Working Capital Formulas Examples And How To Improve It

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

How To Calculate Working Capital Requirement Plan Projections

How To Calculate Working Capital Guide Formula Examples

Changes In Working Capital Fcf And Owner Earnings

Working Capital Management Components Approaches

Answered Begin With The December 31 16 Net Bartleby

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

Working Capital Meaning Ratio Example Formula Cycle

Working Capital An Overview Sciencedirect Topics

Wc Mgt

3

0 件のコメント:

コメントを投稿